The focus, however, is on minimizing the sum of the squared residual terms.Ĭross-Sectional vs. The regression line’s least squares fitting is that the residual term’s expected value is zero. If Capex increases by one unit, the ROA will increase by 1.12%.The return on assets for a company is 6.171% if the company has no capital expenditure.On the other hand, a negative slope indicates that the dependent and independent variables are in opposite directions.įrom the previous example, we would interpret the coefficients as follows: A positive slope indicates that the dependent and independent variables are moving in the same direction. The slope is the one-unit change in the independent variable that will cause a change in the dependent variable. However, in some contexts, this is not always true.

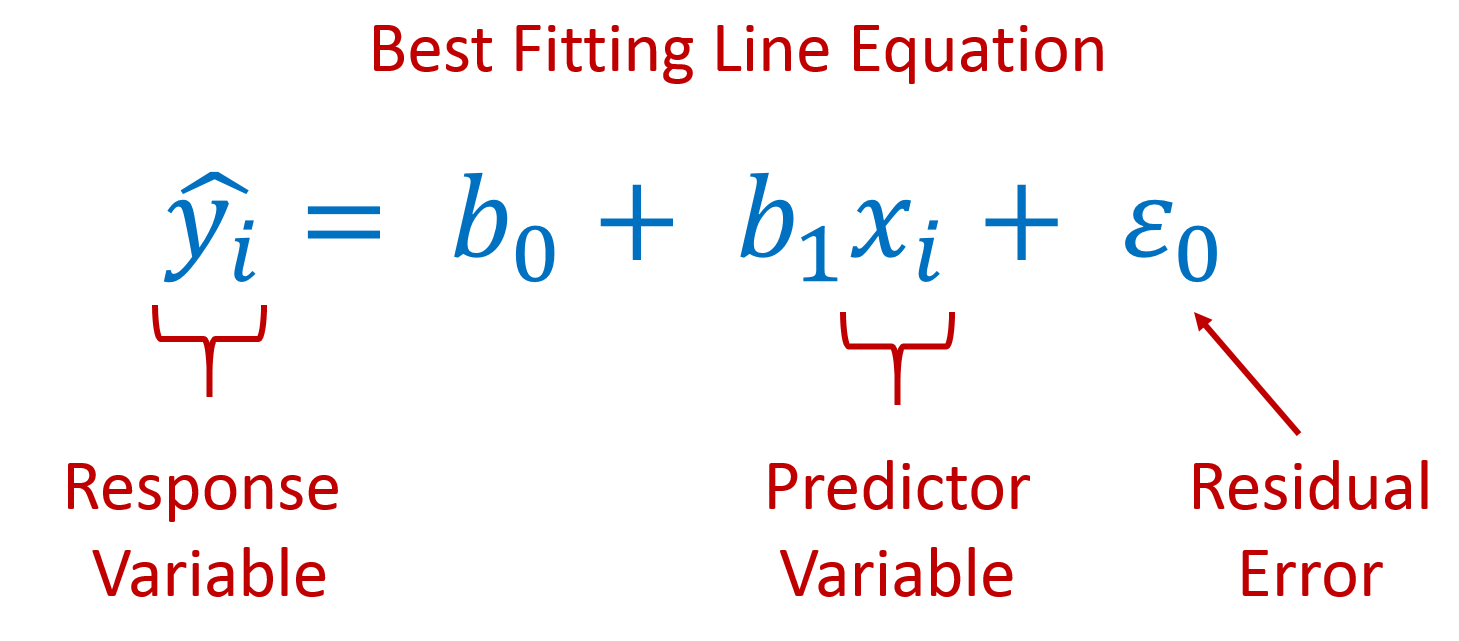

The intercept is the expected mean value of the dependent variable when the value of the independent variable is zero. When conducting a simple linear regression, the estimated slope \(\hat\beta_0\) and the intercept \(\hat\beta_1\) are such that the sum of the squared vertical distance from the observations to the fitted line is minimized. Since the population parameters values \(\beta_0\) and \(\beta_1\) cannot be observed in a regression model we use only and which are estimates, and testing is based on estimated values in relation to the hypothesized population values.

\(b_0\) and \(b_1\) are known as Regression Coefficients. The least-square criterion is used to measure the accuracy of a straight line by minimizing the squared deviations from the line. While conducting a regression analysis, we start with the dependent variable whose variation we want to explain and the independent variable that explains the changes in the dependent variable.

0 kommentar(er)

0 kommentar(er)